EV Charging Business Model Exploration: Part 1 - Home is Where the Charge Is

A glorified plug socket gets installed by a consumate pro

This is the first of a series of articles in which I explore some of the business models in the market, how they are looking to succeed both today and their long term upside, plus the risks they face.

There are a heap of ways to cut the EV charging market, but I like to start by dividing it in line with the "Charging Ecosystem" concept that Erik Fairbairn created at Pod Point, and I will end by discussing some of the ancillary services in the Charge Point Operator (CPO) space.

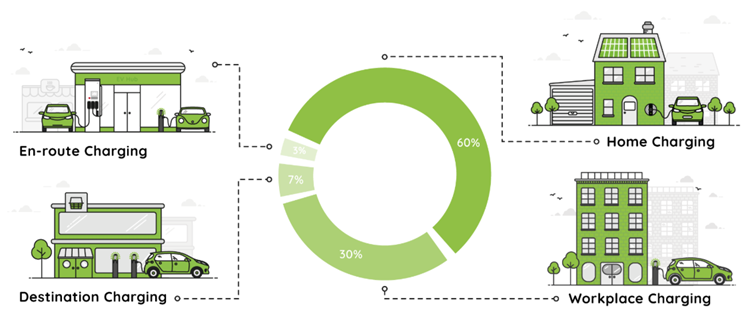

Charging Ecosystem

A trusty ol' friend - if you've seen me speak on EV (charging) you'll have seen this diagram. These numbers are a projection of what proportion of energy will flow through which part of the charging ecosystem in a mature market (think 10+ years' time). They smooth over a ton of nuance, but they still feel useful to me as an indication. And if you think that only 10% of charging in public feels low, bear in mind ChargeUp Europe’s State of the Industry Report states that it's currently less (9.2%).

The Charging Ecosystem Concept - by Erik Fairbairn

First up - Home Charging.

Home Charging Approaches - 60%

Today the UK govt estimates this number at about 80%, the decline to 60% is predicted as the ~28% of drivers that don't have off-street parking at home get into EVs. Whatever happens, this is where the vast majority of charging energy gets absorbed.

Home Charger Provision

This has primarily been performed by firms that either source or directly manufacture their charging hardware, either directly install or sub-contract the installation of the charger and make a margin on the sale of each.

The Short Term Play

This is a high-volume, low margin game, but given the importance of Home Charging and the volume of drivers switching to EV, the volumes can provide material revenues. Being disciplined to keep costs down (e.g. all but eliminate aborted installation visits) and ensure margin on the unit and installation is the key short term opportunity.

Accessing volume in the Home Charge market relies on an intelligent approach to market and a clear proposition to customers as to why they should install your charger - which is, frankly, a glorified plug socket. This realisation should highlight the key product factors:

Make the unit smart and unobtrusive on a house: minimise size, ensure decent cable management for tethered units (I would recommend tethered units for convenience) and avoid disco lights

Don’t overload it with features which won’t be used, offer a few useful features that offer real value; and

Nail the installation experience. The install represents minor building works in peoples’ homes, i.e. a sensitive environment, make customers feel confident that you won’t wreck their home.

The Long Term Upside

Deploying a network of connected smart chargers gives the Home CPO the potential to amass a significant asset that can participate in demand side response and flexibility markets (NB: I consider V2X just a type of flex opportunity). Once the hardware and install has been paid for, this activity is high margin, with costs related to network maintenance and support.

We are seeing the first offers in the market that front load future flex revenues to reduce up front costs to the consumer, expect to see more such innovation as confidence in these revenues grows.

The Risks

This is already a healthy and highly competitive market, and given the unparalleled convenience, it feels like Home Charging is here to stay, so long as we keep hold of our own vehicles instead of all ride sharing autonomous vehicles (spoiler alert: I think families outside dense urban centres will).

It is not yet possible to fully realise demand side response and flex market revenues without e.g. full half hourly settlement adoption (despite the super efforts of the likes of Axle Energy) and limited deployment of V2X (and even ISO15118 in market). But there is plenty of scope to get started, with increasing growth.

How the value of flex evolves is uncertain, as more and more flexible assets will join the system alongside ever more intermittent power generation mix. This is a complex question, but the latest thinking I’ve seen suggests that long term value in flex will endure - without radical changes, e.g. achieving energy superabundance.

A current market dynamic sees the potential for future revenues somewhat impeded by the dominance of a particular tariff and the modus operandi of its impressive supplier (who has got to their position absolutely the right way - innovation and keen pricing); while that supplier is also entering the market to provide the charging solution themselves. How this shakes out will be interesting to watch, and may involve some intervention to ensure healthy competition if the current dominance isn't challenged by healthy competition, organically.

There are increasingly challenging regulatory requirements around smart functionality, data reporting, and cybersecurity that add complexity and cost.

Multi-Tenancy Dwelling (MTD) Solutions

These are scenarios where drivers park in a bay in a communal car park near to their place of residence, e.g. flats. For most MTD scenarios it is not practicable to install chargepoints that can be wired back to a driver’s individual home meter. CPOs can provide solutions that combine billing protocols and usually load management to maximise the number of chargepoints that can be installed on the building’s supply.

The Short Term Play

With Part S of the Building Regulations in force, probably the most immediate revenue opportunity is selling charging points and associated systems to MTDs being developed, usually using the existing on site contractors for installation. The scale of this opportunity is material, with sites often requiring tens or even hundreds of chargers across a development.

Retrofitting to existing sites is always tougher than having chargers designed in at construction, but the scope of the opportunity for retrofit is significant.

The Long Term Upside

As with conventional Home Charging the long term upside is in retaining control of the deployed network, to realise recurring revenues. For MTD there is the potential to make ongoing revenues by getting a revenue share from billing services, whilst there is also the potential to use the deployed network as flex assets.

In order to access these ongoing revenues, it becomes imperative to own and operate the networks. With high propensity for utilisation, and access to future revenue potential, some MTD CPOs may want to even fund the installations themselves, levying a fee to drivers per kWh that covers the electricity cost and provides a margin to the CPO.

The Risks

Supplying chargers to meet Part S requirements is a quick win, but a v competitive market. If you are to establish significant volume you need to prove credibility with key developers (a non-trivial endeavour). Or you can try to be the cheapest supplier for those more oriented to box ticking - hardly a high margin opportunity, and getting harder as product floods into market. And, in my experience, the cheapest products in market rarely fully meet reg requirements (there are horror stories here).

You must have a plan to handle the real world challenges that come from customers who didn’t choose your product starting to use them, which has a support cost impact.

For those looking to own and operate MTD charging systems, the complexity is immense. You're dealing with multiple stakeholders (landlords, managing agents, residents groups), often conflicting interests, and significant technical challenges around electrical capacity, installation practicality and billing individual users.

Credible firms can identify viable sites to install at, but once you’ve installed, the payback period will take time, and returns are entirely reliant on residents getting EVs and using the chargers, making pricing highly sensitive. And until utilisation meets that critical breakeven threshold - you’re wearing the risk.

Cross Pavement Charging (NB: I'll tackle "On-Street" in the Destination Charging part of the series)

Solutions like Kerbo Charge's pavement channel are a hardware fix that enables drivers to Home Charge from their own electricity supply, whilst parked on the street outside their house. This enables further opportunity for the conventional Home Charging model identified above.

The Short Term Play

Clearly the opportunity is to make margin on installation and ongoing maintenance of the hardware solution. While the solution means additional cost, it enables the driver access to the lowest tariff charging, and the flex/demand side response revenue opportunities that those with driveways have, making it a compelling offer.

The Long Term Upside

The long term upside relates to the scale of the opportunity. This addresses a genuine market need for a proportion of the ~28% of UK drivers without off-street parking. This likely represents millions of potential customers.

It is unclear that there is a material recurring revenue stream, beyond maintaining the deployed assets.

The Risks

Significant hurdles remain with many local authorities yet to approve these solutions, though guidance from central govt is aimed at helping progress.

The solution only works for scenarios where drivers can regularly park right outside their house on the opposite side of a footpath. Clearly that is not everyone without off street parking.

With limited recurring revenue opportunities, the maintenance fee potential must be balanced against ongoing liabilities, with the potential for settlement and degrading of footpaths a key factor for pavement channels.

Do you agree? Any key facet not covered? What do you think the most exciting opportunities are here?

Next time we’ll explore Workplace Charging…