EV Charging Business Model Exploration Part 2 - Workplace: Charging 9 to 5, What a Way to Make a Living

Work, work, work, work, work…

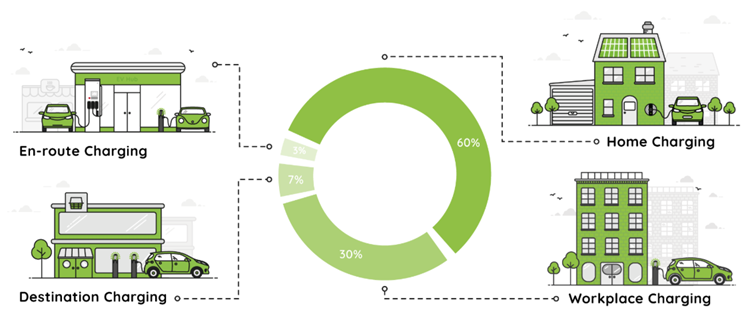

Welcome to Part 2 of my EV charging business model exploration. Having covered Home Charging (which handles 60% of energy in a mature market), we now turn to what could be the biggest commercial opportunity: Workplace Charging.

The Charging Ecosystem Concept - by Erik Fairbairn

Workplace Charging - 30%

At 30%, the charging ecosystem projects that 3x more energy will flow through workplace chargers than the entire public network. A bold statement? Maybe, but also recognition of the scale of opportunity here - with driving the dominant commuting mode in the UK and vast reserves of workplace car parks offering long dwell times perfect for 7kW charging.

If this vision proves correct, Workplace Charging could be the biggest growth area as EVs undergo mass adoption.

Employee Charging

Considered as a perk to aid attraction and retention, companies are increasingly installing charging points for their employee (and visitor) vehicles in company car parks. There is the potential for some higher powered units in some scenarios, perhaps 22kW units for visitors, but this is likely to largely be as many 7kW units installed with load management

The Short Term Play

CPOs typically make margin on hardware supply, installation, ongoing maintenance, including back office provision. And part funding by the govt’s Workplace Charging Scheme (WCS) grant, combined with tax efficiencies, currently assist installations to take place.

I’ve not seen firms look to get CPOs to fund these installations for them. Typically a firm looking to install Workplace Charging must decide whether they would rather have a capex hit - just pay for it up front - or an opex hit - smoothing the costs - which typically is done by a leasing house rather than a CPO.

The Long Term Upside

With so much growth ahead, there is scope for substantial revenues from provision of charging infrastructure for many years to come.

Workplace charging offers excellent utilisation patterns - cars sit parked for ~8 hours, allowing for lower charge rates and, as it is during the day, there is the opportunity to make use of peak solar generation to keep costs down. This creates opportunities for sophisticated energy management and flex market participation (including potential for V2X services) - all recurring revenue opportunities.

The Risks

It is challenging to find sufficient electrical capacity in order to scale provision to meet even existing/imminent demand, let alone the significant demand to come. The supply to most workplace car parks is almost always insufficient to provide charging to each bay, and bringing in more grid is often prohibitively expensive. But this reality, combined with predictable usage patterns, makes room for innovations like battery storage options.

Post 2020 moves to flexible working reduced the amount of commuting, but not sufficiently to undermine this market - and momentum seems to be switching back towards more conventional working patterns as the COVID pandemic recedes into memory.

Typical ownership of the charging infrastructure by the employers (or their landlords) can limit the opportunity for CPOs to make margin on electricity, particularly with likely affordable pricing being offered to employees. There is also a potential for the employer/landlord to seek a solution where the chargepoints are managed by third party software providers, which can limit the scope for CPOs to derive flex revenues etc. This desire for ownership flexibility has seen "OCPP" compliance on hardware become an ever higher priority in this space, as it allows owners of chargepoints to (at least in theory) change the back office software provider - clearly not a happy outcome for a CPO.

This is already a highly competitive market, albeit one that could generally be further developed in its market fit (many chargers are repurposed home or public chargepoint designs), meaning CPOs will have to make and deploy a compelling charging solution and a winning approach, with pressure on their margins.

Commercial Fleet Charging

Charging of the company’s own vehicle fleet, e.g. a fleet of vans in a depot. The fleet charging infrastructure can be a subtle, or radically different solution than what is required for employee charging, depending on the nature of the fleet and its dwell time at base.

For example, if a commercial fleet returns to base overnight and can be recharged at ~7kW loads sufficiently for the morning, the charging solution might be much like that of employee charging. But if vehicles have very short downtimes at base, and/or are larger vehicles that consume more electricity, the fleet operator may seek to install higher powered DC chargers - a wholly different undertaking with much higher grid requirements.

NB: a typical new 100A three phase supply can support 1 x 50kW DC charger, 3 x 22kW AC chargers or 27 x 7kW load managed chargers.

The Short Term Play

For CPOs, margins on the kit and installation are the immediate opportunity, and with so much growth arriving in this part of the ecosystem, these revenues are non-trivial.

Fleet managers are also typically early adopters, as they are tasked with taking a holistic look at whole life cost - and this potentially offers volume during the market's earlier growth phase.

Fleet charging offers the advantages of high utilisation and predictable patterns, so immediate recurring revenues may be possible from selling software services.

The Long Term Upside

The long term upside potential for fleet charging is similar to those for employee charging - direct revenues on infrastructure from the massive uptake to come, and energy management and flex market participation (including potential V2X services) - the latter less appropriate for DC charging.

DC charging installations are so expensive that there may be scope to offer them to public/third party drivers outside of core hours for the fleet’s use in order to gain more revenue. We’ve started to see the likes of bus depots offering chargers when the fleet are out and about in the day, as they tend to charge the buses overnight.

The Risks

Fleet requirements are demanding on the charging infrastructure - high reliability, sophisticated reporting, integration with existing fleet management systems - this strains the operational phase capabilities of CPOs - hardware, software, support and maintenance services. While the sales cycles are long and complex.

A particular challenge for CPOs is that fleet charging's long-term value often lies in the software layer rather than the hardware. Fleet operators increasingly want integrated solutions that combine charging with route optimisation, predictive maintenance, driver behaviour analytics, and real-time operational dashboards.

While the recurring revenue opportunity is substantial, it may flow more to fleet management software providers than traditional charging infrastructure companies. CPOs either need to offer/develop sophisticated, integrated software capabilities themselves, or risk being commoditised as socket suppliers to more integrated fleet tech solutions.

DC charging installations are expensive. A fleet seeking to invest in these solutions needs to be clear eyed about what the payback is (usually from enabling greater fleet uptime) and how long it will take. The latter is of great import if there is a risk of the business leaving the premises before this payback had been achieved - you can't take grid connections with you.

Do you see Workplace Charging as the sleeping giant of EV charging? What's been your experience with employee charging schemes?

Next time we'll explore Destination Charging - charging where you were going to go anyway…