EV Charging Business Model Exploration Part 3 - Destination Charging: Public Charging Starts at Your Destination

Destination Charging is everywhere, even at the zoo

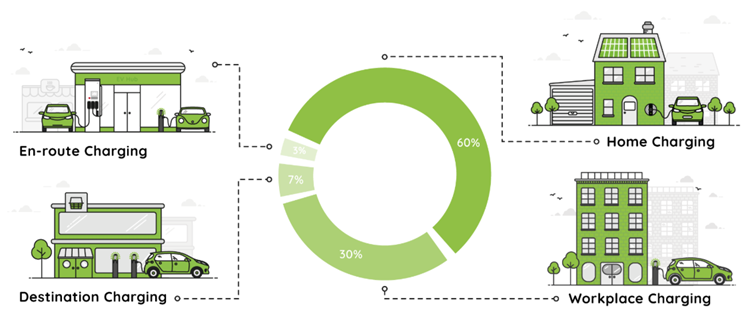

Welcome to Part 3 of my EV charging business model exploration. Having covered Home Charging (60% of energy) and Workplace Charging (30%), we now turn to Destination Charging - the 7% that happens where you were going to go anyway - making it a really convenient form of public charging for drivers.

The Charging Ecosystem Concept - by Erik Fairbairn

Destination Charging - 7%

Ideally, Destination Charging is a background activity - charging that happens somewhere you were going to park anyway. Since we park at a multitude of locations with a range of different dwell times, there are different requirements for different scenarios.

Anything less than 20 minutes typical dwell time is not really suitable for Destination Charging. If anything, this is suited to ultra rapid charging and features in the “En Route Charging” category, where drivers are seeking out a charger for the primary purpose of charging. So we should consider Destination Charging anything from >20 minutes to overnight charging.

AC charging (7-22kW) typically matches well with retail/leisure dwell times (i.e. >40 mins or so), whilst it’s possible that DC offers flexibility for drivers who need it on shorter stops, this substantially increases the costs. As such, offering >75kW is a questionable ploy at a Destination, unless seeking to play as an En Route Charging Location as well.

While low powered charging infrastructure in short dwell time locations will suffer from poor utilisation, high powered charging infrastructure installed in high dwell time locations is likely to suffer a similar fate, but can have worse outcomes. E.g. hotels should think VERY carefully before installing DC chargers. They eat the valuable grid capacity for (and cost vastly more than) the AC chargers that would fill guests’ car batteries happily overnight.

However, rather than segmenting by dwell time, the key distinction is the business model - who funds and operates the infrastructure - the site owner, or “Host”, or the CPO. And so this section considers “Host Funded”, “CPO Funded”, and ends with an exploration of “On-Street” Destination Charging.

Host Funded

This is where the Destination Charging Host (e.g. retailer, hotel, leisure facility etc) pays for and owns the charging infrastructure, viewing it primarily as a customer amenity rather than revenue centre. Hosts purchase charging equipment outright and pay for installation, typically using existing electrical capacity, where possible.

The Short Term Play

CPOs make margin on hardware supply and installation, while allowing the Host to set the fee. Often a proportion of any fee offers the CPO a limited ongoing revenue opportunity, together with maintenance and support. Many Hosts initially offered free charging as a customer acquisition tool, though high electricity prices have made this less sustainable.

The appeal of this model for Hosts is full control over pricing (including free), customer experience, and the ability to integrate charging with their existing customer systems (loyalty cards, apps, etc.). By making charging affordable, Hosts can attract custom that increases core revenues, rather than a pure revenue opportunity.

The Long Term Upside

As EV adoption grows, offering Destination Charging will become a genuine differentiator for a variety of businesses and attractions. Premium pricing is possible in some locations, particularly where it is offering the highest convenience, but being able to keep your pricing competitive will be critical as EVs undergo mass adoption. Scaling the utilisation with growing uptake, also scales secondary benefits of loyalty cards, apps etc offers material long term upside to Hosts.

Long dwell time applications offer the potential for additional revenues from demand side response/flex market opportunities to Hosts and/or CPOs. Though care must be taken to ensure the use case is appropriate for these opportunities.

The Risks

In recent years high electricity pricing has seriously discouraged potential Destination Charging Hosts from investing in their own charging infrastructure, and effectively ended the "free charging" model that many Hosts originally envisioned. Many would-be Hosts are afraid of incurring big electricity bills and are reluctant to enter the market. Those who do are usually more attracted to the CPO Funded approach, which offers them an immediate return.

Without ongoing CPO ownership, Hosts bear elements of operational risk, or at least are committed to ongoing fees to cover equipment failures, software updates and support. Many lack the expertise to manage charging networks effectively, risking inappropriate installations that can lead to unnecessary costs and poorly utilised solutions.

Without direct ownership, CPOs are less secure in seeking to benefit from demand side response/flex market revenue opportunities.

CPO Funded

CPOs fund, install and operate charging infrastructure at destination sites, typically with revenue-sharing agreements with Hosts - and often paying a rental fee to the Host.

The Short Term Play

CPOs cover capital costs in exchange for revenue share or site rental fees, thus removing initial financial risk from Hosts, and ensuring professional operation and maintenance. Revenue comes from fees levied for charging, though Hosts often expect these to be kept low to maintain the customer acquisition benefit.

The challenge is balancing Host expectations of affordable customer charging with commercial viability, whilst agreeing to a contract of sufficient length to offer a realistic payoff for the CPO. Many agreements involve complex revenue splits that account for the Host's customer acquisition value.

The Long Term Upside

Deployment at scale across multiple destination sites can create network effects and operational efficiencies. Premium pricing becomes possible in high-convenience locations, particularly where alternatives are limited. Data from multiple sites provides insights for optimisation and additional service offerings.

Demand side response/flex market participation can be built into the model from the off, giving the CPO much more secure access to these revenue streams, where this is appropriate (i.e. typically on longer dwell time applications).

The Risks

Host expectations often conflict with commercial viability - they want to attract customers with cheap/free charging while CPOs need sustainable revenue. Seasonal or irregular usage patterns (particularly at leisure destinations) make revenue forecasting difficult. Many sites generate insufficient revenue to justify dedicated management, leading to operational challenges.

Competition for prime sites has been intensifying, with Hosts able to demand increasingly unfavourable terms from CPOs eager to secure location access to grow their network.

These long term agreements often see Hosts committing to someone else setting an effective paywall to visit their site. If the UK is to - hopefully - emerge from this period of exceptionally high electricity pricing, the Host owned model may remerge and see those who’ve signed up the CPO funded model substantially undercut in the market, making their sites less attractive to EV drivers.

Long term contracts at high prices are also risky for the CPO, should electricity prices recede and Hosts begin to primarily see charging as a customer attraction amenity, rather than a revenue stream again. It’s easy to conceive of assets being stranded.

On-Street Charging

Whether this actually counts as de facto Home or Destination Charging is debatable, as it is technically public charging, while the intent is to get as close as possible to a Home Charging experience. If it succeeds at scale, it is likely that its energy component sits more in the Home Charging part of the ecosystem. However, I have addressed it in Destination Charging for pure reasons of balance in my article lengths!

The Short Term Play

Conventional chargepoints installed in on-street scenarios have proven largely uneconomic, usually providing two charging bays that require a suite of permissions, road closures and new grid connections. So we're starting to see more nuanced approaches like retrofitting lampposts with charging sockets that make use of existing electrical infrastructure.

CPOs typically own the On-Street Charging infrastructure, making their revenue by levying a margin on the electricity fee, while some local authorities (the de facto “Host") seek revenue share, others view it as resident service provision.

The Long Term Upside

The long term upside relates to the scale of the opportunity. This addresses a genuine market need for a proportion of the ~28% of UK drivers without off-street parking, and represents millions of potential customers.

There has been talk of trying to bill On-Street Charging in such a way that it essentially works its way back to your domestic electricity bill. This would be an excellent innovation, but will currently fall foul of the higher 20% VAT on public charging vs 5% domestic VAT rate.

If we see a future with high penetration of On-Street Charging, we should expect to see innovative approaches to deploy at scale with minimal civils work, minimal street clutter, minimum ongoing maintenance requirements and maximum ease of use for customers. Those approaches that involve plunging a lance into a false kerb seem interesting to me.

Those who say On-Street Charging will never happen because we will never dig up that many streets to lay cable in them, should consider the broadband rollout. We have done exactly this, if it becomes the optimal approach.

The Risks

As well as the inherent impediments of deploying charging infrastructure in the public realm, there is a chicken and egg problem with On-Street Charging, at least before the era where a car is assumed electric by default. Until such time on-street parking capacity has been planned out of towns for decades in order to discourage car use, and that which is left is fought over tooth and nail. If councils start to dedicate chunks of parking bays as EVs only they will have a short term as councillor. Of course, without the dedicated EV bays much of the On-Street Charging infrastructure is “ICEd” (occupied by a petrol/diesel car). This dichotomy may be overcome in time, but if other parts of the charging ecosystem (where it is easier to install) develop fully, there is a risk that full development of On-Street Charging is not required.

Installing conventional Destination Charging solutions in local car parks that can be easily used overnight by local residents is one approach that is already making fast progress, and may be a particular threat to On-Street Charging.

Of course lamppost charging requires such little disruption that rapid deployment is possible. But there are three limiting factors on scaling lamppost charging:

The existing lighting network capacity - Most lamppost company chargers max out around 5kW, as this is the spare capacity in the circuit. But this circuit will support a significant number of lampposts, so you will quickly overload the capacity as multiple cars on the street plug in, meaning charge rates will be shared, or even charges are sequenced if capacity would otherwise be below the minimum threshold. So you may be plugged in for a long time without receiving much charge.

Lamppost location - Many lampposts are now installed back from the kerb to stop damage from errant drivers. Once there is a footpath between the lamppost socket and the parking bay, there is no longer a nice easy installation available.

Street clutter - Even if you overcame the prior two, there is a limit to how many lampposts are required on a street. One of the benefits of lamppost charging is that it prevents a heap of pedestal chargepoints cluttering a street. But installing a chargepoint for every two parking bays makes a lot more sense than fitting heaps more lampposts.

Ultimately scaling On-Street Charging requires significant civils work and the introduction of new electrical supplies. This can be somewhat mitigated with innovation, but it is always challenging to deploy in the on-street environment.

Do you see CPO owned Destination Charging as here to stay, or will Host Funded rollouts return? Do you think we'll do public On-Street Charging at scale?

Next time we'll explore En Route Charging - Just 3%?! Even so it’s a key enabler for everything else...