EV Charging Business Model Exploration Part 4 - En Route Charging: Essential for a long Cruise, but do you see The Need for Speed or a Risky Business?

Launch day at InstaVolt's spectacular Winchester hub

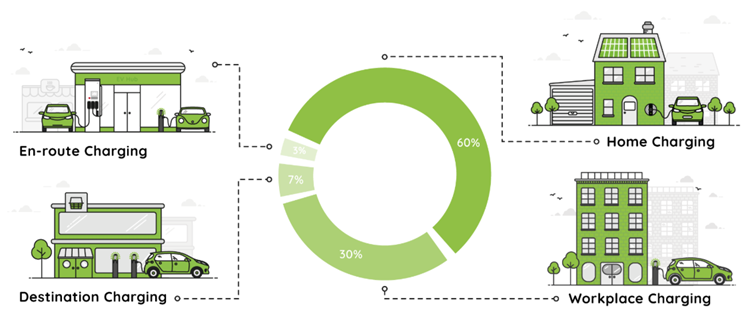

Welcome to Part 4 of my EV charging business model exploration. Having covered Home Charging (60% of energy), Workplace Charging (30%), and Destination Charging (7%), we now turn to En Route Charging - the smallest segment by volume but still critical for EV mass adoption.

The Charging Ecosystem Concept - by Erik Fairbairn

En Route Charging - 3%

En Route Charging is high powered DC charging that enables drivers to extend the range of their car in the shortest time possible, usually to continue the journey that they are on.

At just ~3%, it always surprises (particularly ICE car drivers) that this energy proportion is so small, but that’s just the nature of living with an EV (see the explanation of Rapid Charge Paradox (RCP) Ltd's name). And while the energy volume is relatively small, the emotional impact of a strong En Route Charging network on the driver is massive:

With: your EV is as free to explore the world as an ICE car

Without: your car is materially limited to half its range - you have to get there and back.

En Route Charging is also likely the most “Box Office” of the Charging Ecosystem. With massively capital intensive installations of very high powered chargers, often accompanied by facilities for drivers at large hub sites. The potential margin on each charge event is also likely the largest.

Given it is by far the most capital intensive part of the ecosystem, only funded roll out models are at play. It is not feasible for any business to speculatively invest £100ks on a sideline venture.

Rapid/Ultra-Rapid Highway Charging

Large hub sites located near to major trunk roads looking to attract drivers on long journeys who need to get more charge quickly to complete their journey.

The Short Term Play

High-powered chargers (>150kW) cost >£100k each to install, require significant grid connections, and need premium locations, where there are plenty of drivers in need of quick charge to complete their journey - this is really a distress purchase. Revenues come from margin on high per-kWh pricing, justified by speed and necessity.

Given the early stage of the market and the irregular nature of when people need these chargers, utilisation is currently quite low. Meaning there is no real short term profitability play. The short term goal is all about accessing the best sites and buying up the grid to secure it for the long term, while you design your site and charging solution to optimise for customer experience.

Optimising customer experience means offering the right service and facilities at a price that enough customers are willing to pay. E.g. whether to erect a canopy over the chargepoints. There is a discourse of enthusiasm for providing canopies to keep the rain off drivers plugging in, just as there are at petrol forecourts. However, I'm not sure I'm convinced. We don’t stand at our car while it charges, if putting in a canopy adds £s to my charge for the 20 seconds it takes me to plug in - I’m fine briefly in the rain thanks. Your mileage may vary - you may care deeply about this! So there needs to be a balance, and somewhere in that balance is the optimal customer experience.

The Long Term Upside

Those networks that secure the best locations and deliver reliable charging experiences can command premium pricing with high customer loyalty. Network effects become powerful - drivers prefer networks with broad coverage and proven reliability. As EV adoption reaches mass market, utilisation will improve dramatically, driving these sites into profitability.

The locations with the strongest competitive moats - motorway service areas, key trunk road intersections, secured feasibly available grid capacity - can effectively guarantee high-margin revenues from a captive market of drivers who have limited alternatives when they need to charge en route.

The Risks

As for any infrastructure investment in a fixed asset, utilisation risk is absolutely paramount. Massive capital requirements with long payback periods, combined with intensifying competition, create a challenging investment environment where utilisation takes years to build and location decisions are often irreversible.

The ongoing grid costs and site rents that En Route Charging firms must stomach are non-trivial. Recent changes to grid fee structures have made these fees truly punishing in the early years with relatively light utilisation. There are hopes that these structures can be addressed, and the likes of ChargeUK are working on this issue.

The technology risk is also significant - rapid DC charging is currently increasing in power, with 350kW the effective standard at motorway locations, but proven 1MW technology emerging from China. Of course, the higher the power, the higher the cost. So En Route Charging operators have to make decisions on where their market sweet spot sits, determined by both ability of EVs on the road to make use of the highest power charging (most can't currently take 350kW), and propensity of drivers to pay for it, vs driver desire for quick En Route stops.

Despite some optimistic projections, the current commercial reality is challenging across all segments. Most CPOs are burning cash to build market position, betting on future profitability as the market matures. The fundamental challenge is that an infrastructure is being built for a mass market that doesn't quite exist yet, while competing on price with an incumbent (petrol) that's had a century to optimise its business model.

There was a unique challenge in the UK posed by the “Rapid Charging Fund”, where a substantial sum of money (£0.9bn) was set aside by the govt to pay for grid upgrades at motorway service areas. Poorly chosen terms saw the scheme unable to get moving, and for a good number of years the threat of this public money (still not quite receded) nixed much potential private sector investment, as companies couldn’t risk seeing competitor sites subsequently receiving subsidy that would make it impossible to compete.

Urban Hubs

There are those who believe the En Route Charging model of minimising the charging time by maximising the charging power will enable drivers to charge their EVs in a similar manner to how drivers refuel their ICE cars. If this is to happen, hubs in highly populated locations would be highly utilised.

As well as private car use, vehicles with a heavy urban duty cycle need En Route Charging provision in urban areas to extend their range too.

The Short Term Play

Some urban hubs are having some joy capturing commercial fleet traffic already, which gives them some valid utilisation, during off-peak hours and providing premium rapid charging for private drivers who can't access workplace or home charging. Installation costs are similar to highway sites but without the same necessity-driven demand.

The Long Term Upside

Though I do not see a viable path to it, it is possible that electricity from high powered DC chargers becomes affordable, and extremely high powered charging, like BYDs 1MW charging, becomes a mass market phenomenon - in which case there is strong upside potential for these sites near lots of vehicles that can’t be charged via Home Charging.

Those locations that can target the commercial vehicle fleet doing high volumes of urban mileage may have strong utilisation that will only grow over time as more of the fleet goes electric.

Those that can locate their sites on their own land can avoid costly rents to landowners, giving them a key commercial advantage over competitor hubs, and/or give them lower utilisation requirements, making commercial viability more achievable. An example of this might be sites owned by conventional fuel retailers, or supermarkets.

The Risks

Urban hubs have all the same risks as Highway Charging, albeit potentially lower rents. As such, the fundamental economics are challenging. Urban drivers (will) have (multiple) charging alternatives - Workplace, Destination, even potentially cross-pavement Home Charging options. Why pay premium prices for rapid charging when you can charge more cheaply elsewhere? The value proposition works for drivers in genuine need of quick miles or commercial fleets optimising for time over cost. Many urban hub concepts have struggled to achieve viable utilisation rates.

While I am often more sceptical about the prospects of En Route Charging than much of the discourse, and many of my colleagues in the industry - many of whom are doing a fine job developing the En Route Network in their firms - I must stress that I believe it is absolutely essential to EV mass adoption, and so long as those investing here are clear eyed about the scale of its potential and pitfalls, there will be big winners here.

Next time we'll explore the Ancillary CPO Services - the services in-between and behind the scenes that will realise revenue streams that could make the difference between success and failure across all these charging segments.