EV Charging Business Model Exploration Part 5 - Ancillary Services: Adam Smith Would Approve - We’re Specialising

My current charging apps. A vision of hell? Hardly.

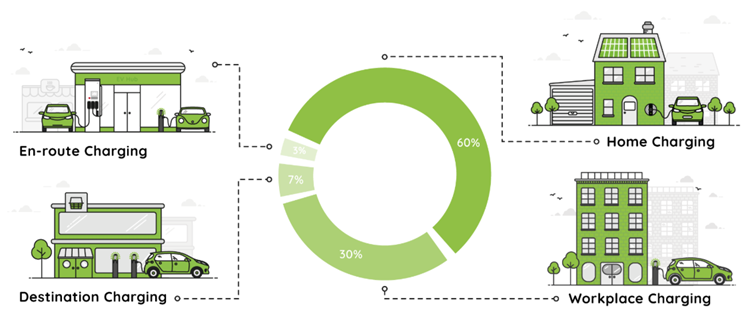

Welcome to Part 5 of my EV charging business model exploration. Having covered Home Charging, Workplace Charging, and Destination Charging, and En Route Charging we now turn to the critical enablers that sit between and behind all these segments - the Ancillary Services that are increasingly defining success in the Charging Ecosystem.

The Charging Ecosystem Concept - by Erik Fairbairn

The Great Unbundling

Ten years ago, the UK's EV charging industry was dominated by vertically integrated CPOs. Companies like Pod Point (now Pod) and Chargemaster (now bp pulse) did most of everything themselves - developed products, sourced hardware manufacture, installed it, operated the network, handled payments, provided customer support. It was the only way to ensure quality in an immature market where specialised suppliers simply didn't exist.

But both of those firms have pivoted away from their initial models, presenting an opportunity to new entrants. And as the market has matured and scaled, we've witnessed what happens in every growing industry - specialisation. Without the moat of incumbency, the jack-of-all-trades CPO model is increasingly giving way to partnerships of focused specialists who do one thing brilliantly. Just as the early automobile manufacturers eventually gave way to specialist tyre makers, glass suppliers, and electronics firms, the EV charging industry is disaggregating into its component parts.

This isn't just natural market evolution - it's essential for the industry's success. The complexity of delivering charging at scale means no single company can excel at everything. The CPOs that will win are those that recognise this and build ecosystems of specialist partners rather than trying to maintain end-to-end control.

The Specialist Ecosystem

Payment and Roaming Platforms

The first crack in the vertically integrated model appeared via payment interoperability. Drivers didn't want ten different apps and RFID cards - they wanted to charge anywhere with a single solution.

e-Mobility Service Providers (eMSPs)

eMSPs like Electroverse, Paua, and Bonnet have emerged to aggregate access across multiple charging networks. They handle customer relationships, provide unified billing, and offer the promise of "one app to rule them all."

The Short Term Play

eMSPs make margin on transaction fees, and some with subscription revenues, typically taking a percentage of the charging revenue. With relatively low capital requirements compared to infrastructure deployment, they can scale quickly by signing up both drivers and CPO networks.

Perhaps the best opportunity lies with fleet customers who genuinely need centralised billing and reporting across their entire vehicle portfolio. For these commercial users, the administrative simplification justifies some additional cost.

The Long Term Upside

In theory, eMSPs could become the primary customer relationship owners, much like mobile virtual network operators (MVNOs) in telecoms. They could layer on additional services - insurance, vehicle leasing, energy tariffs - creating significant customer lifetime value.

The data aggregation opportunity is substantial. Understanding charging patterns across networks provides insights valuable to grid operators, vehicle manufacturers, and urban planners.

The Risks

Here's where I become a dissenting voice on the future of eMSPs platforms in the UK: they're solving a problem that - for the typical (non-commercial fleet) driver - barely exists. Sure the idea of having a heap of apps sounds bad, but in practice - how often does the average driver encounter a new charging network? Once every few months? Twice in a week on a holiday? The "hassle" of downloading a new app for a 10-15% discount versus using an aggregator is trivial - it takes two minutes and there’s a danger most drivers will gladly do it.

By their very nature, eMSPs risk increasing the cost of charging - they're inserting themselves as middlemen who need to make margin. If this is simply to save you from occasionally downloading an app, I am very concerned about the inherent value. This isn't like roaming mobile networks abroad where the alternative is impossibly complex.

Perhaps there is a way that e-MSPs can provide additional value, or somehow secure even better pricing than the CPOs themselves to secure their position with the driver. But it is not at all clear to me that this is inevitable. Until then, the price differential between direct and roaming access is likely to widen, not narrow, making the economics increasingly unattractive for price-conscious drivers.

The push for contactless payment acceptance at all public chargers >8kW (a curiously named threshold, BTW!) also risks hurting the core value proposition. If drivers can tap their bank card anywhere, the friction eMSPs claim to solve disappears entirely. And if they don’t want the transaction fee that makes this more expensive, this suggests a price sensitivity that will lead them to get the CPOs own app.

However, I stress for a fleet manager, this aggregation service is valuable. It is notable that the areas that have made most progress are very much modelling themselves on the fuel card system, with the likes of Allstar investing in this space. It is in fleet management I believe the best, and very credible, opportunity lies.

On the European continent, the value of MSPs is greater with much more common travel across borders, where downloading the correct app from your domestic app store can prove a challenge. Clearly there is still some value here with European drivers on UK roads, and vice versa, but it is proportionately less significant. (Doing nothing for our "Island Mentality" stereotype there!).

Roaming Hubs

The technical infrastructure enabling interoperability between CPOs and eMSPs, e.g. Hubject or Gireve. They're the plumbing that makes the decentralised system work.

The Short Term Play

Transaction fees on every roaming charge provide immediate revenue, though margins are thin (typically 1-2% of transaction value). The business model relies on volume, processing millions of charging sessions.

The Long Term Upside

With roaming becoming mandatory through the PCP Regs, these platforms could become essential infrastructure with strong network effects.

Perhaps the really big potential to expand into adjacent services like Plug&Charge authentication (see below) and grid services coordination.

The Risks

The fundamental question remains whether roaming adds value or just cost. If enough drivers realise 10-15% savings by going direct to CPOs, the entire roaming ecosystem weakens. Direct bilateral agreements between major players could bypass hubs entirely.

The biggest prize - being the authentication body for huge volumes of global transactions, means big competition. Can today's firms ward off (or acquired by?) the giants of payment handling?

The Plug&Charge Problem (and Prize)

Plug&Charge (via ISO 15118 - in the process of being mandated), promises a future where drivers won't need phone apps to pay for their charge at all. The car handles authentication and payment automatically when you plug in. Pricing will likely appear on the vehicle display. The entire transaction happens seamlessly in the background.

However, someone will handle that transaction layer - managing the certificates, routing the payments, handling clearing between thousands of CPOs and millions of vehicles. This isn't something CPOs can build individually, and car manufacturers won't want the complexity of managing payments across hundreds of charging networks globally.

This creates a winner-takes-all dynamic. Whoever becomes the dominant Plug&Charge transaction handler - whether it's Hubject, Gireve, or a dark horse we haven't seen yet - will clip a fee on potentially billions of charging sessions annually. We're talking about becoming the Visa or Mastercard of EV charging.

The prize is enormous, but only a handful of players can win - probably just one or two globally. Every current intermediary is desperately positioning for this role, but most will fail. The winners will be those who can sign up the most CPOs and OEMs quickly, creating network effects that lock out competitors.

For these Roaming Hub companies, this isn't just an opportunity - it's potentially an existential necessity. Miss out on owning the Plug&Charge layer and you're relegated to running legacy infrastructure for a shrinking pool of app-based charging. Win it, and you're sitting on one of the most valuable positions in the entire EV ecosystem.

Energy Management and Flexibility

As the grid handles evermore intermittent renewable generation, and electrification of heating and transport increases demand, sophisticated energy management has become critical. This has spawned a new category of specialists.

Flexibility Aggregators

Firms like Axle Energy , ev.energy and Jedlix don't own charging infrastructure but orchestrate it to provide grid services.

The Short Term Play

These platforms make money by aggregating small flexible loads (including long dwell time, charging mainly Home Charging, but also Workplace Charging) into virtual power plants (VPPs) that can respond to grid signals. Revenue comes from grid service payments, shared with asset owners.

Current opportunities include:

Demand Side Response (DSR) payments for reducing consumption during peak periods

Frequency response services for grid stability

Time-of-use arbitrage, charging when electricity is cheap

The Long Term Upside

As covered in the Home Charging Business Model Exploration, the real opportunity is the sheer scale of controllable load that's coming. By 2035, the UK alone could have 20 million EVs. If even half are plugged in during peak evening hours, that's 70-100GW of flexible capacity that can be orchestrated - more than the entire current UK generation capacity.

The value here is in smart charging at massive scale - delaying, accelerating, or modulating charging speeds provides enormous value to the grid without requiring any special hardware beyond what's already being deployed. Just shifting charging by a few hours across millions of vehicles creates a virtual power plant of unprecedented scale.

V2G technology, when it arrives at scale, will add another layer of capability by enabling bidirectional power flow. But we don't need to wait for V2G to realise the flexibility opportunity - the aggregation of millions of standard EV chargers is transformative on its own.

The software-only model means infinite scalability without capital deployment. A single platform could theoretically manage flexibility across millions of chargers. As regulations evolve to properly value flexibility, revenues could increase dramatically.

The aggregator controlling this fleet wouldn't just be valuable - they'd be essential to grid stability in a renewable-heavy system. Every EV becomes a grid asset, and someone needs to orchestrate that symphony.

The Risks

Success depends entirely on regulatory frameworks that properly value flexibility - these are still evolving, inconsistent and often frustrate progress.

Flex providers must make a compelling offer to hardware manufacturers to keep working with them, rather than developing capabilities directly into their products.

With no infrastructure requirement, barriers to entry are relatively low. That said, the likes of Axle Energy have proven seriously impressive in realising revenues, and such tangible results are a strong competitive advantage.

Energy Management Platforms

These are developed by software houses like Fuuse and Monta, providing the software layer that optimises charging across sites, managing load, pricing, and user access. To some extent this is the traditional CPO back office software, albeit provided by a dedicated, specialised firm.

The Short Term Play

SaaS fees from CPOs and site hosts provide predictable recurring revenue. These platforms typically charge per charger per month, with additional fees for advanced features like dynamic pricing and load management.

The Long Term Upside

As charging infrastructure becomes commoditised, the software layer captures increasing value. These platforms become the operating system for electric mobility, essential for managing complex multi-stakeholder charging ecosystems.

The data flowing through these platforms - usage patterns, pricing elasticity, energy consumption - becomes increasingly valuable for optimisation and planning.

The Risks

Of course large CPOs may choose to develop capabilities in-house rather than rely on third parties, particularly if they get to a scale where these fees become prohibitive vs inhousing it - though things are definitely moving in the opposite direction, currently.

This is a competitive market, and again, as a software only play, there is a limited moat to keep out smart new entrants. And open protocols like OCPP could enable site hosts to switch platforms easily, reducing lock-in and pricing power.

Specialist Physical Hardware and Services Providers

As the industry matures, we're seeing emergence of highly specialised providers addressing specific operational needs.

Installation Contractors are the backbone of the entire Charging Ecosystem. With the scale of growth ahead, there's no shortage of work on the horizon - these businesses benefit from healthy margins on commercial work (~20-30% for installation services) and the current supply-demand imbalance. However, they face the classic challenges of project-based businesses: irregular cashflow, working capital requirements, and limited recurring revenue. The sector also faces an acute threat as both EV charging and heat pump installation compete for the same limited pool of qualified electricians.

Hardware Specialists face a different challenge: increasing commoditisation. As standards like OCPP become more prescriptive and commonplace, differentiation becomes harder. This commoditisation inevitably favours volume manufacturers, often in the Far East. Meanwhile, as the increasingly separate software layer captures the long-term revenue opportunities, hardware providers are left competing primarily on price and reliability - a tough spot.

Maintenance Specialists like Safer Charging arguably represent an intriguing long-term opportunity. This is an area that has been underserved to date - public charger reliability often sits below required uptime, harming drivers’ experience and the industry's reputation. But arguably the operational phase of Workplace and MTD style charging have been even more neglected, with a fit and forget approach often frustrating drivers and CPOs alike.

Unlike installation or hardware sales, maintenance offers genuine recurring revenue through service contracts, typically structured as monthly fees per charger plus call-out charges - these revenues justified by ensuring appropriate utilisation and happy drivers. As the installed base grows, this becomes a massive addressable market.

The Integration Challenge and Its Risks

While specialisation brings expertise and efficiency, it creates complexity. CPOs must orchestrate multiple partners - hardware suppliers, installers, payment providers, energy managers, maintenance firms - and when things go wrong, accountability becomes murky. A charging failure could stem from any component, with each provider pointing fingers at others.

The seamless experience that Tesla provides with its vertically integrated Supercharger network becomes harder to achieve when seven different companies deliver a single charging session. There's also the risk of value extraction - as specialists gain market power in their niches, they might capture increasing shares of the value chain, squeezing CPO margins, discouraging rollout.

Success will likely belong to CPOs that excel at ecosystem orchestration rather than end-to-end delivery, focusing on their core competency while partnering for everything else. But the question remains: who captures the most value in this disaggregated ecosystem - customer-facing brands, infrastructure owners, or software platforms?

The next decade will determine whether the EV charging industry follows the path of other infrastructure sectors toward specialisation and modularity, or whether the complexity of delivering reliable charging at scale demands a return to vertical integration.

Rapid Charge Paradox (RCP) Ltd's bet? The specialists are here to stay. The companies that recognise this shift and build strong partnership ecosystems will be the winners. Those still trying to do everything themselves will find themselves outcompeted by nimbler, more focused competitors.

Do you see specialisation as strengthening or fragmenting the charging ecosystem? Which ancillary services do you think will capture the most value?

That concludes my Business Model Series. The sector continues to evolve rapidly, and new models are emerging all the time. The winners will be those who can adapt quickly, partner effectively, and relentlessly focus on solving real customer problems.

Thanks for reading!